See if you qualify to enroll in health coverage now. The application is available daily from 6 a.m. to 11 p.m.

See if you qualify to enroll in health coverage now. The application is available daily from 6 a.m. to 11 p.m.

See if you qualify to enroll in health coverage now. The application is available daily from 6 a.m. to 11 p.m.

See if you qualify to enroll in health coverage now. The application is available daily from 6 a.m. to 11 p.m.

To be eligible for health insurance through Maryland Health Connection, you must:

You may be eligible for Medicaid now, even if you weren’t in the past. The best way to know if you’re eligible for Medicaid is to apply. Your child or a member of your household may be eligible for Medicaid even if you’re not.

Pregnant individuals of any immigration status are eligible for Medicaid or the Healthy Babies Program.

A child may stay on a parent’s plan until the end of the year in which the child turns 26.

Children can join or remain on a parent's plan even if they are:

If you have employer coverage, you can purchase a private health plan through Maryland Health Connection. You will only be eligible for financial assistance to lower the cost of coverage if your employer coverage is considered to be unaffordable or if it does not meet some basic standards, known as providing minimum value.

Employer coverage is considered affordable if the cost you pay annually for coverage is no greater than 9.02 percent of annual household income.

Employer coverage provides minimum value if it covers 60 percent of health care costs on average. Your employer should be able to tell you if your plan meets this standard.

Use this employer tool worksheet to help you gather information about employers that offer traditional health coverage to anyone on your Maryland Health Connection application.

After a job loss or reduction in hours, your company may offer you coverage under the Consolidated Omnibus Budget Reconciliation Act (COBRA). This is an opportunity to continue your current health coverage for typically up to 18 months at an increased personal cost, since you will be paying the portion your employer used to pay.

If you already have enrolled in coverage through COBRA, you must either wait for open enrollment in the fall or wait for your COBRA benefits to expire before you can enroll through a special enrollment period with Maryland Health Connection.

If you have not yet enrolled in COBRA, you can estimate the cost and benefits of Maryland Health Connection coverage to compare with that of COBRA. Use our Get an Estimate tool to understand your options before making a decision.

If you disagree with a decision made by Maryland Health Connection, you may request a case review. Maryland Health Connection will review your information and the decision to make sure it is correct. If the case review shows that the decision is incorrect, Maryland Health Connection will fix it.

If you are still dissatisfied after the case review, you may request a hearing before the Office of Administrative Hearings. If you have any questions about this information, contact the Call Center at 1-855-642-8572. Deaf and hard of hearing use Relay.

More information about appeals.

Marylanders can apply during open enrollment Nov. 1-Jan. 15. Enroll Nov. 1-Dec. 31 for coverage beginning Jan. 1. Enroll Jan. 1-15 for coverage beginning Feb. 1. You can enroll in health coverage any time of year if you qualify for Medicaid or the Maryland Children's Health Program (MCHP). Certain life events qualify you to enroll in a health plan outside of open enrollment.

You can apply for coverage and financial help in any of the following ways:

1) Online – Create an account, complete your application, choose a plan and enroll online.

2) In Person – Complete your application in person with free, local help.

3) Phone – Call 1-855-642-8572. Deaf and hard of hearing use Relay service. Help is available in more than 200 languages.

4) Mobile App – Download our free mobile app, Enroll MHC, from the App Store (iPhone) or the Google™ Play Store (Android) to apply from your phone.

When you apply for coverage, you’ll need to provide this information about yourself and each member of your household who is enrolling:

If you apply during open enrollment Nov. 1-Jan. 15, your coverage date will depend on timing.

If you are eligible for Medicaid or MCHP, your coverage begins on the first day of the month that you applied. For example, if you apply on Dec. 18 and are found eligible, your coverage will be considered effective as of Dec. 1.

You may also be able to get help with medical bills that you incurred up to 3 months before you applied. Applicants who need retroactive coverage and did not select this option during online enrollment should contact their local health department or department of social services.

If you enroll in or change your plan during a special enrollment period, in most cases, between the 1st and the 15th of the month, your coverage will begin on the 1st of the following month. If you report your new plan selection between the 16th and the last day of a month, your coverage will begin on the 1st of the next following month. For example, if you select your plan July 16, your coverage will begin Sept. 1.

For some life events, your coverage may be available sooner.

You can purchase a plan directly from an insurance company, but you will not be eligible for any financial assistance.

In most cases, when you apply for coverage, the account holder / primary applicant should be the household member you want as the contract holder with your insurance company. Some things to consider:

When you apply through Maryland Health Connection, you’ll find out if you qualify for financial help or for free coverage through Medicaid. You may qualify for different types of financial help depending on your:

Look up your income and household size to see if you may qualify. If you’re pregnant or have a family with children, you may earn more and still qualify.

You can use tax credits to help pay your monthly health insurance premiums.

To be eligible for tax credits, you must enroll through Maryland Health Connection and meet certain income requirements.

You are not eligible for tax credits if you are eligible for Medicaid or have access to affordable coverage through your job.

Find out more about tax credits.

You can use cost-sharing reduction credits to help pay your out-of-pocket costs such as copays or deductibles.

To be eligible for cost-sharing reductions, you must enroll through Maryland Health Connection and select a Silver plan.

Learn more about cost-sharing reductions.

When you apply for financial help, you’ll need to estimate your income for the year you want health coverage to see if you qualify for lower costs. You can quickly calculate your income with one of these tools:

All plans through Maryland Health Connection must cover preventive services without charging a copayment or coinsurance. This is true even if you haven’t met your yearly deductible. These services are free only when delivered by a doctor or other provider in your plan’s network. Read more about preventive services for adults, women and children.

You will pay the lowest costs for services when you see a doctor or provider in your plan’s network.

Call your doctor’s office to ask if he or she accepts your insurance, check with your insurance company, or use the doctor search tool.

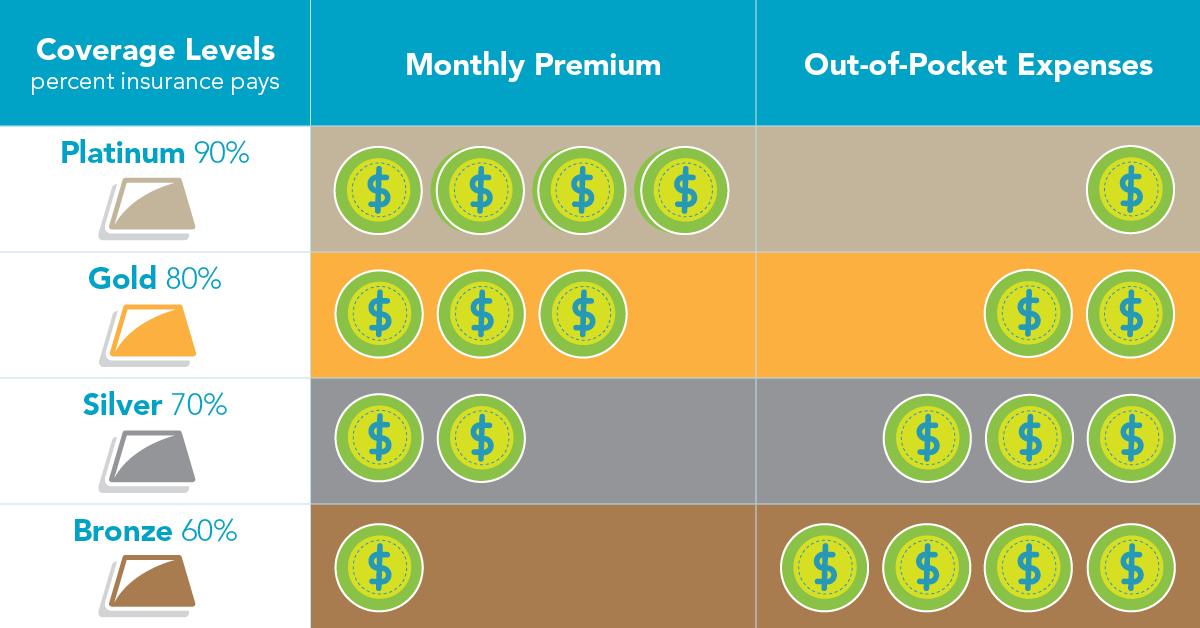

The Platinum, Gold, Silver, and Bronze plan categories cover different percentages of your medical expenses. These major types of coverage are designed to make it easier for you to compare plans. Health insurance plans that cover more of your expenses when you receive health care services – for example, when you visit the doctor or go to the hospital – will typically have a higher monthly premium.

You can buy a dental-only plan or a health plan that includes dental on Maryland Health Connection during open enrollment Nov. 1–Jan. 15. Certain life events qualify you to enroll in a dental plan outside of open enrollment.

Maryland Health Connection has partnered with VSP® to offer vision care to Marylanders. Adults can compare plans and enroll directly through VSP at any time of year.

Generally, your household includes the people you put on your tax form: you, your spouse, and any children or relatives you financially support. Learn more about dependents and who to include.

You may have to provide documentation that can verify your information on your application such as: income, identity, residency, Social Security number, citizenship or immigration status.

If you don’t have the requested information, you may submit a written statement using one of these affidavits for different situations including: If you have no income, or income from self-employment.

Application Affidavits:

Fluctuating Income

Self-employment Income

Social Security Income

Other Income

No Income

Exemption from Obtaining a SSN

Residency

Non-incarceration

Click Forgot Your User ID or Password on the login screen. If you do not have an email address or cell number associated with your account or have forgotten both your user ID and email call us toll-free at 1-855-642-8572. Deaf and hard of hearing use Relay.

To cancel your health plan or Medicaid coverage, log into your account at and use the End My Current Coverage link.

Request cancellation by the last day of the month you want your coverage to end.

Get help ending your coverage.

It’s important to update your information right away if you’ve had changes in your household or income, like pregnancy, marriage or job loss, to be sure you are receiving the right coverage and financial help. See the full list of changes to report.

Medicaid provides health coverage to millions of Americans, including eligible low-income adults, children, pregnant women, elderly adults and people with disabilities. You can enroll in Medicaid any time of year.

You may be eligible for Medicaid now, even if you weren’t in the past. The best way to know if you’re eligible for Medicaid is to apply. Your child or a member of your household may be eligible for Medicaid even if you’re not. Pregnant individuals of any immigration status are eligible for Medicaid or the Healthy Babies Program.

If you are eligible for one of these programs, enroll online at MarylandHealthConnection.gov or get help enrolling.

Apply for Medicaid at any time.

If you are enrolling in Medicaid for the first time or if the state automatically assigned you to an MCO, you may change your MCO one time within 90 days. You may change MCOs for any reason within the first 90 days of initial enrollment.

If you do not change within 90 days, you must remain with your MCO for 12 months before you can change again. You can change your Medicaid MCO once a year.

You also may change MCOs in select circumstances, such as combining all household members or children into the same MCO, or if you moved and your current MCO does not provide service in the county where you now live.

In Maryland’s HealthChoice program, health care services are provided through managed health care organizations, called MCOs. Use the chart to help pick your MCO.

If you do not pick an MCO within 28 days, you will be automatically assigned to one.

Ask your doctors which MCOs they accept, or use the MCO provider search tool.